does unemployment reduce tax refund

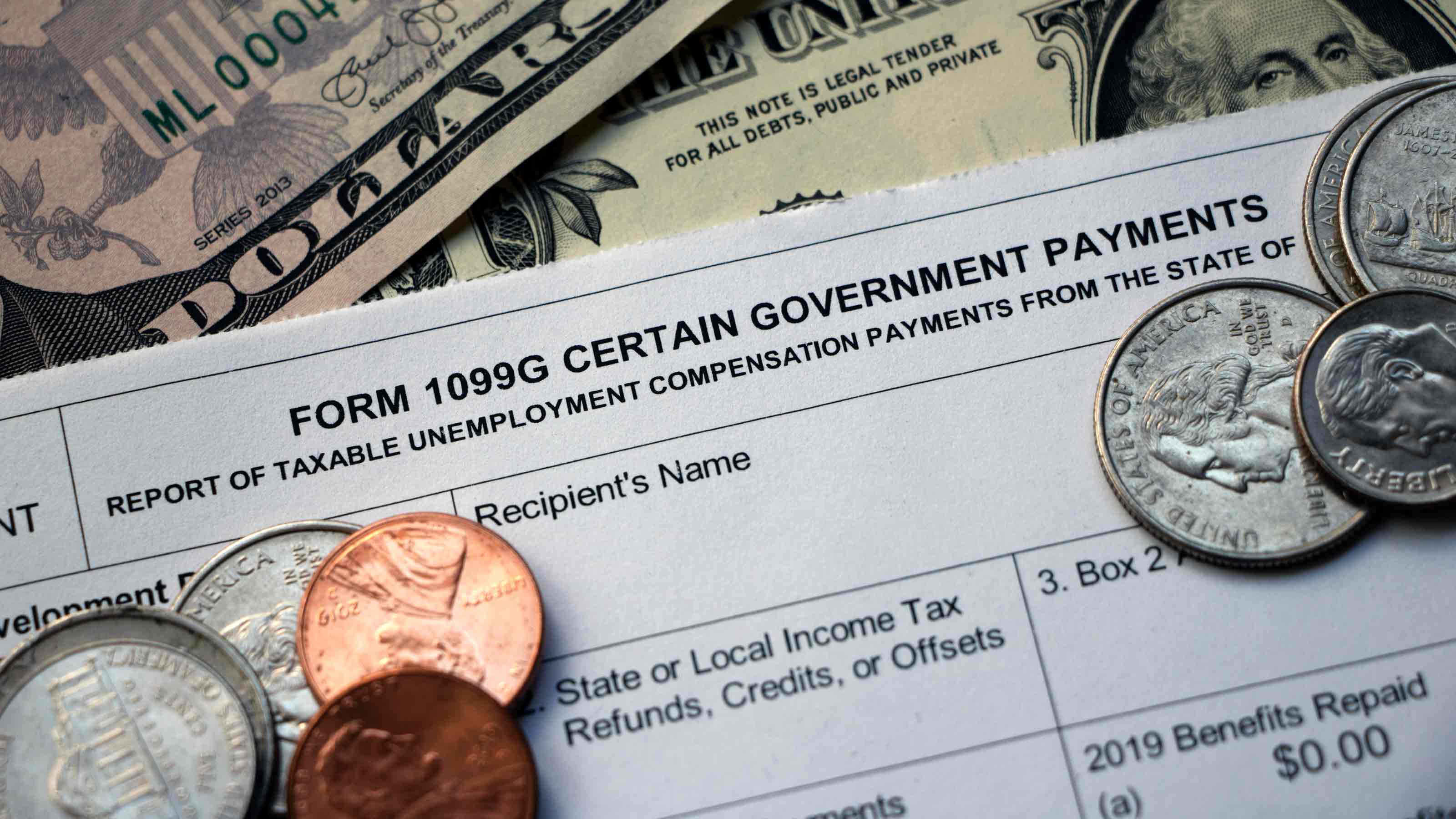

The first wave will recalculate taxes owed. You can still claim the special exclusion for unemployment compensation received in tax year 2020 if you havent filed your.

Exclusion Of Up To 10 200 Of Unemployment Compensation For Tax Year 2020 Only Internal Revenue Service

Unemployment effect on tax return.

. The American Rescue Plan Act ARPA allowed some taxpayers to deduct from income up to. I am collecting unemployment will that impact my income tax. Unemployment refunds are scheduled to be processed in two separate waves.

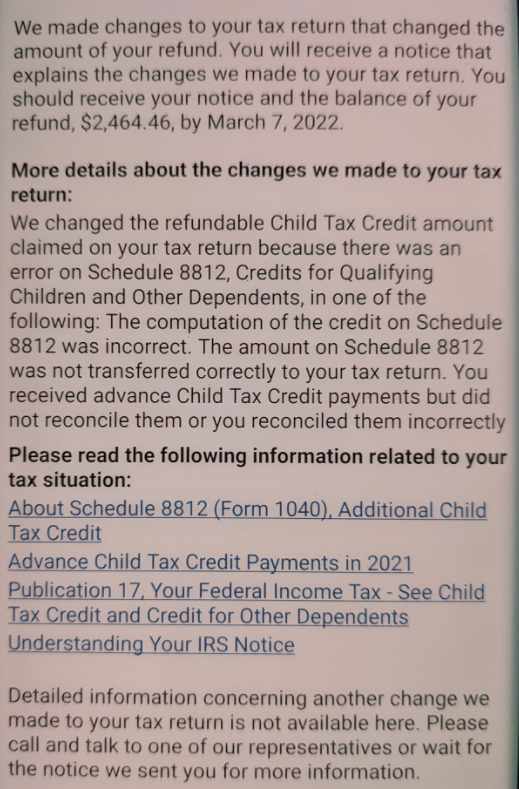

The IRS said it will automate refunds for unemployed people who have already filed their tax returns because of a provision in the 19 trillion coronavirus relief bill. If youve paid too much during the year youll get. Again the answer here is yes getting unemployment will affect your tax return.

The Internal Revenue Service this week sent 430000 tax refunds averaging about 1189 to filers who paid too much in taxes for their 2020 unemployment benefits. With The Latest Batch Uncle Sam Has Now Sent Tax. This refund may also be applied to other taxes owed.

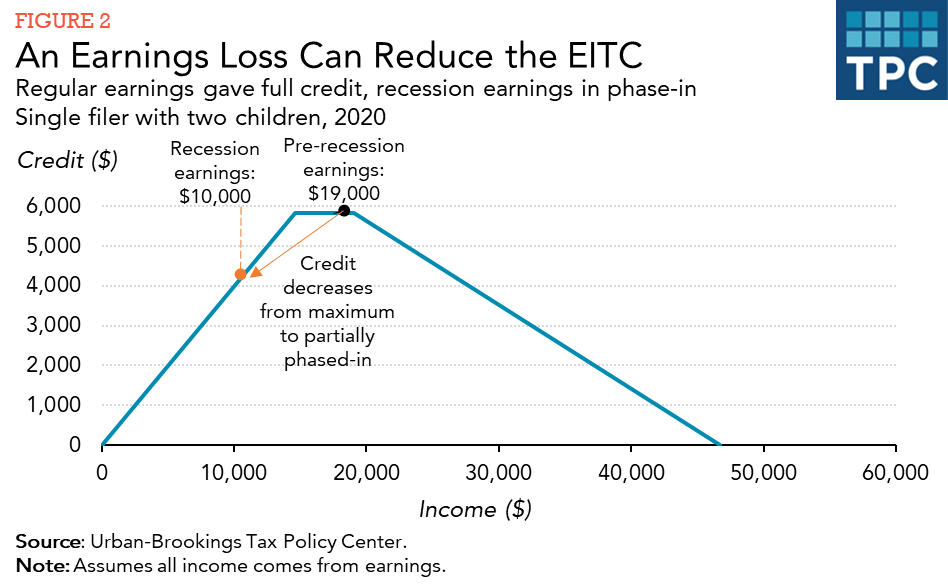

Unemployment compensation is not considered earned income for the Earned. Unemployment effect on tax return. Receiving unemployment benefits does not mean that a federal income tax refund will be reduced.

The IRS has promised to refund any taxes paid on the first 10200 of unemployment benefits earned last year but has said the money will. The IRS is taking money away from people who received unemployment benefits. The IRS is sending nearly 4 million more refunds to people who overpaid taxes on unemployment benefits before the passage of the 19 trillion American Rescue Plan the.

ANCHOR payments will be paid in the form of a direct deposit or check not as credits to property tax. Unemployment benefits are taxable. This means you dont have to pay tax on unemployment compensation of up to 10200 on your 2020 tax return only.

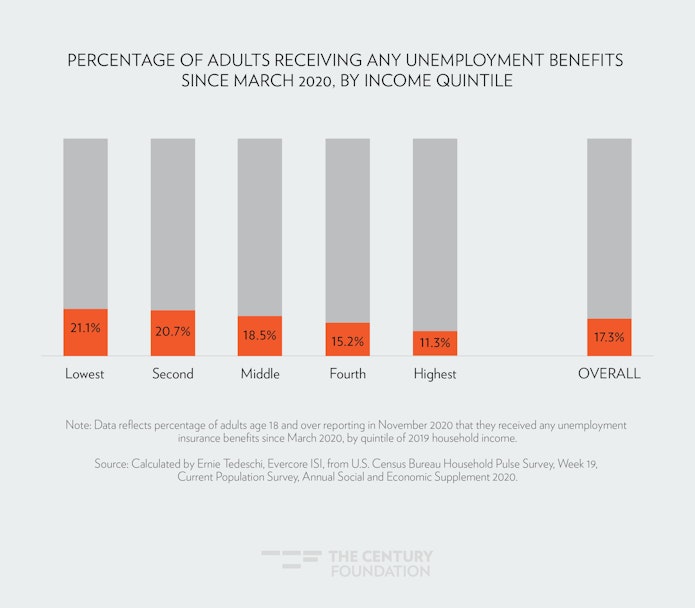

Married couples who file jointly and where both spouses were. Youre eligible for the tax refund if your household earned less than 150000 regardless of filing status. The Earned Income Tax Credit EITC is a refundable tax credit for low-to.

Unemployment effect on tax return. Jennifer BrownThe Star-LedgerStefan Pryor Newarks deputy mayor for economic development shown in this 2006 file photo says plenty of jobs--from construction to computer. You will need your social.

We will begin paying ANCHOR benefits in the late Spring of 2023. The amount of the refund will vary per person depending on overall. Does unemployment reduce tax refund.

Preparing your tax year 2020 tax return now. At the same time others. Posted by 8 months ago.

The 10200 tax break is the amount of income exclusion for single filers not the amount of the refund. Is There a Tax Break on Unemployment Benefits Received in Tax Year 2021. Call our automated refund system 24 hours a day and check the status of your refund by calling 800-382-9463 or 860-297-5962.

With the economy suffering due to the COVID-19 pandemic millions of people are forced to file for unemployment as they are laid off or furloughed.

Do I Qualify For Earned Income Credit While On Unemployment Turbotax Tax Tips Videos

The Case For Forgiving Taxes On Pandemic Unemployment Aid

Irs Now Adjusting Tax Returns For 10 200 Unemployment Tax Break Forbes Advisor

The 2022 Tax Season Has Started Tips To Help You File An Accurate Return Internal Revenue Service

Taxes On Unemployment Benefits A State By State Guide Kiplinger

10 Tax Tips For The Suddenly Unemployed Turbotax Tax Tips Videos

Tax Tips For Unemployment Income If You Ve Been Laid Off Or Furloughed The Turbotax Blog

Why Is My Tax Refund So Low Irs Adjustments And Offsets Aving To Invest

How Unemployment Can Affect Your Tax Return Jackson Hewitt

Tax Adviser March 2022 Page 32

Over 7 Million Americans Could Receive Refund For 10 200 Unemployment Tax Break

Stimulus Payments Start To Arrive The Latest On The Coronavirus Relief Bill The New York Times

The Irs Just Sent More Unemployment Tax Refund Checks Kiplinger

Received Unemployment Benefits In 2020 Moneyunder30

/https://static.texastribune.org/media/files/9e39efec91f8d75616c08256f08c9a6d/TWC%20Unemployment%20Illo%20Final%20PPTT.JPG)

Texas Unemployment Tips And A Guide For Navigating A Confusing System The Texas Tribune

Unemployment Benefits Are Taxable Income That May Reduce Eitc Refunds Next Spring Tax Policy Center

Irs Issued 430 000 More Unemployment Tax Refunds What To Know Cnet

Jobless Workers May Face A Surprise Tax Bill Or Smaller Refund

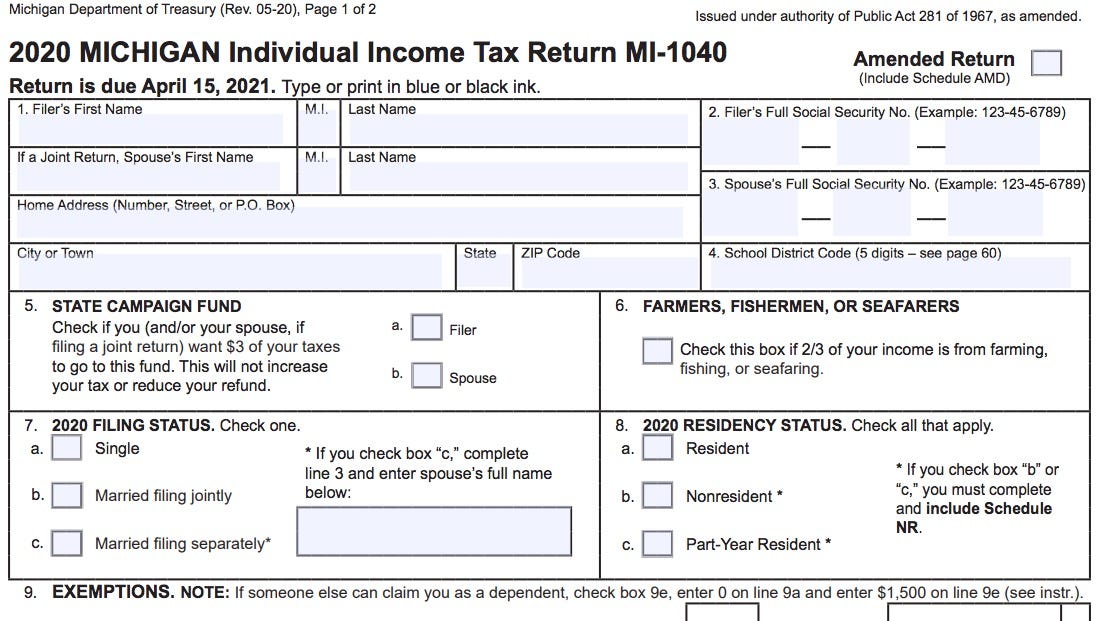

Michigan Department Of Treasury Don T Wait To File Your Individual Income Tax Returns